It applies to most goods and services. Airlines in Malaysia provide various options to domestic business travellers to manage their GST tax invoices.

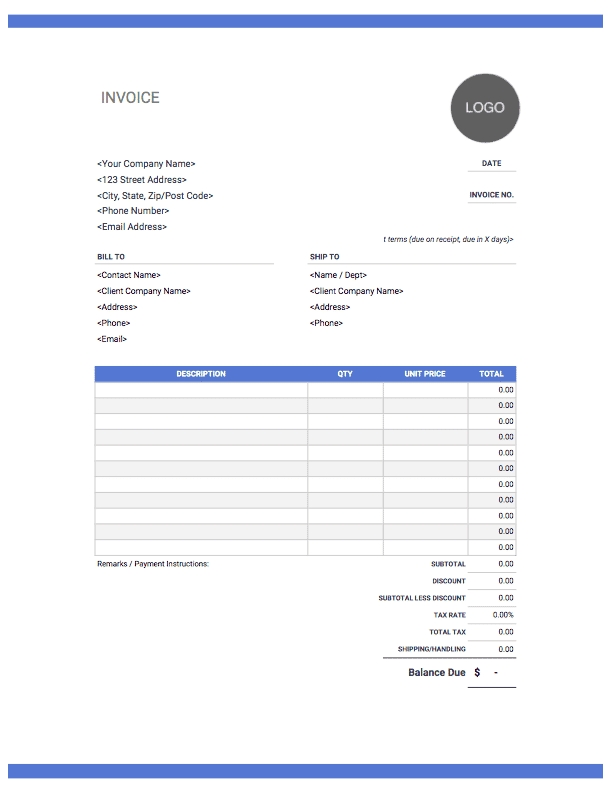

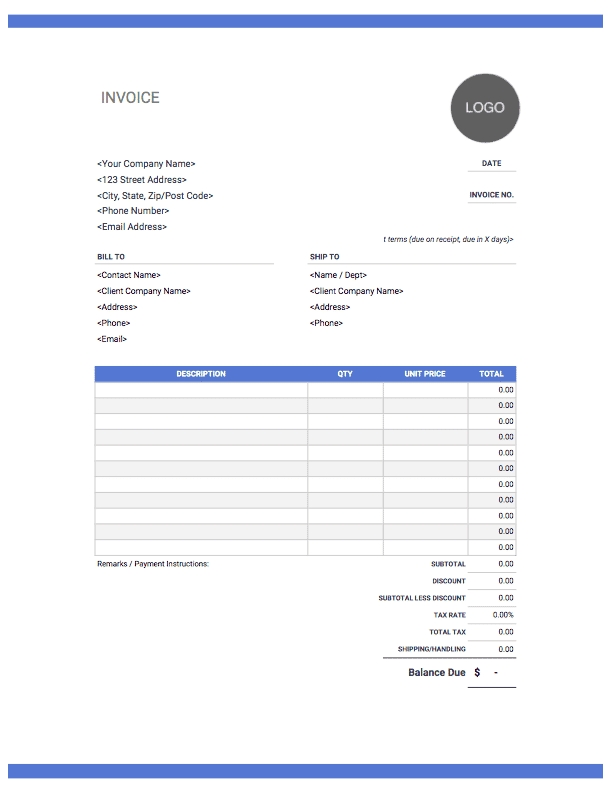

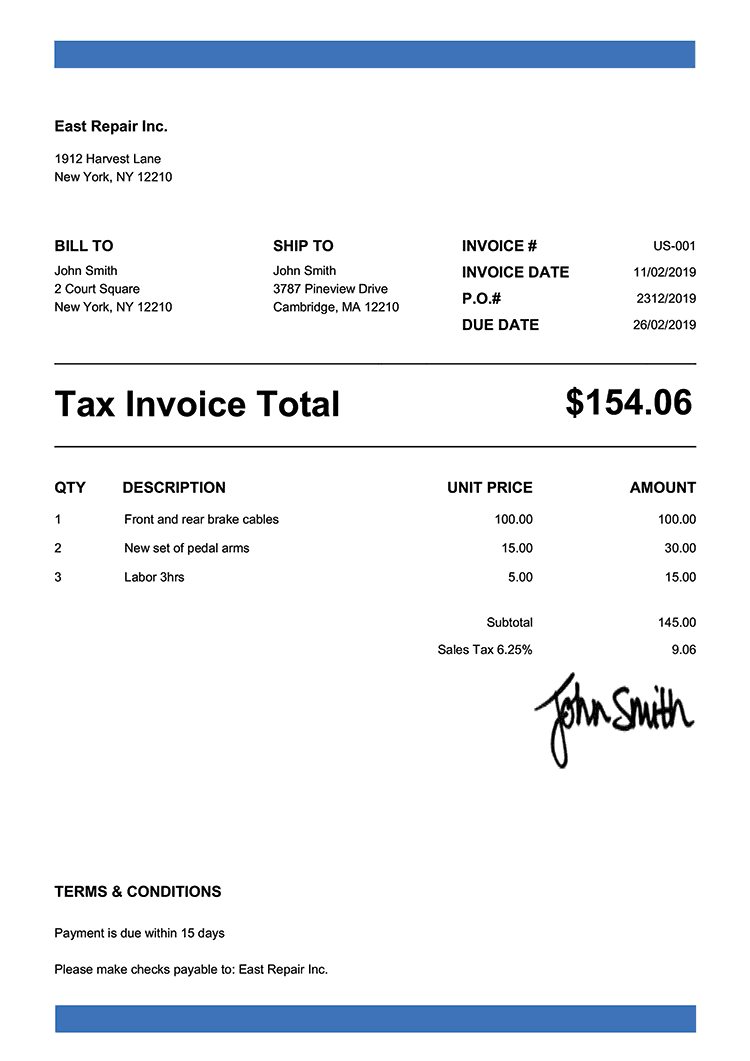

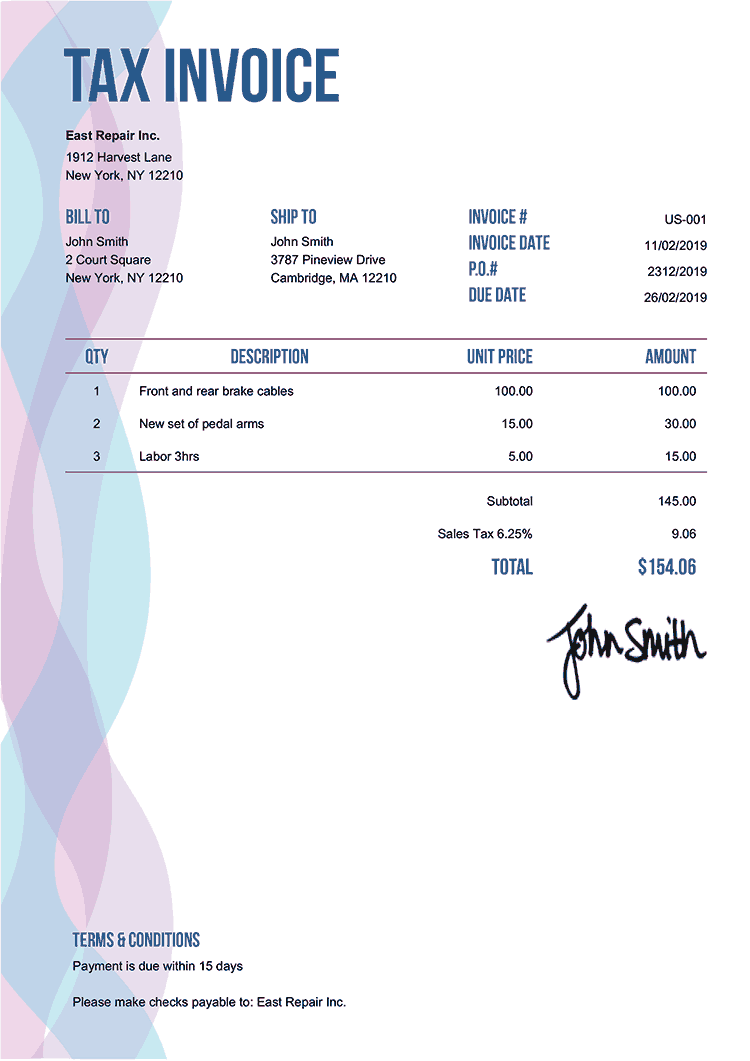

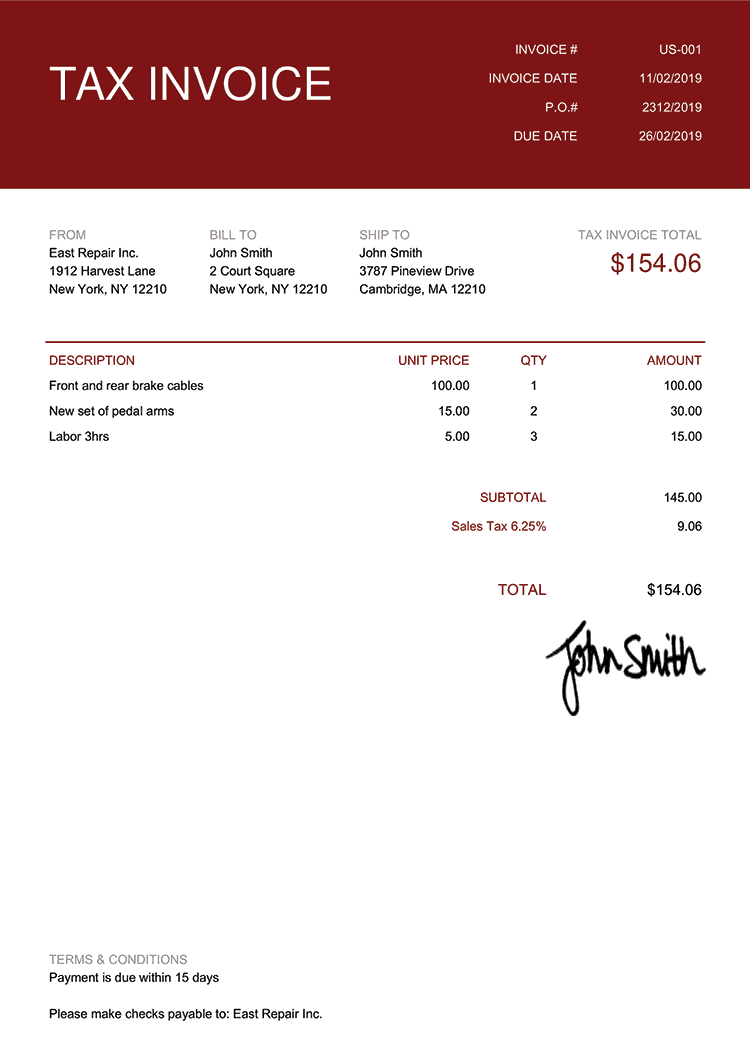

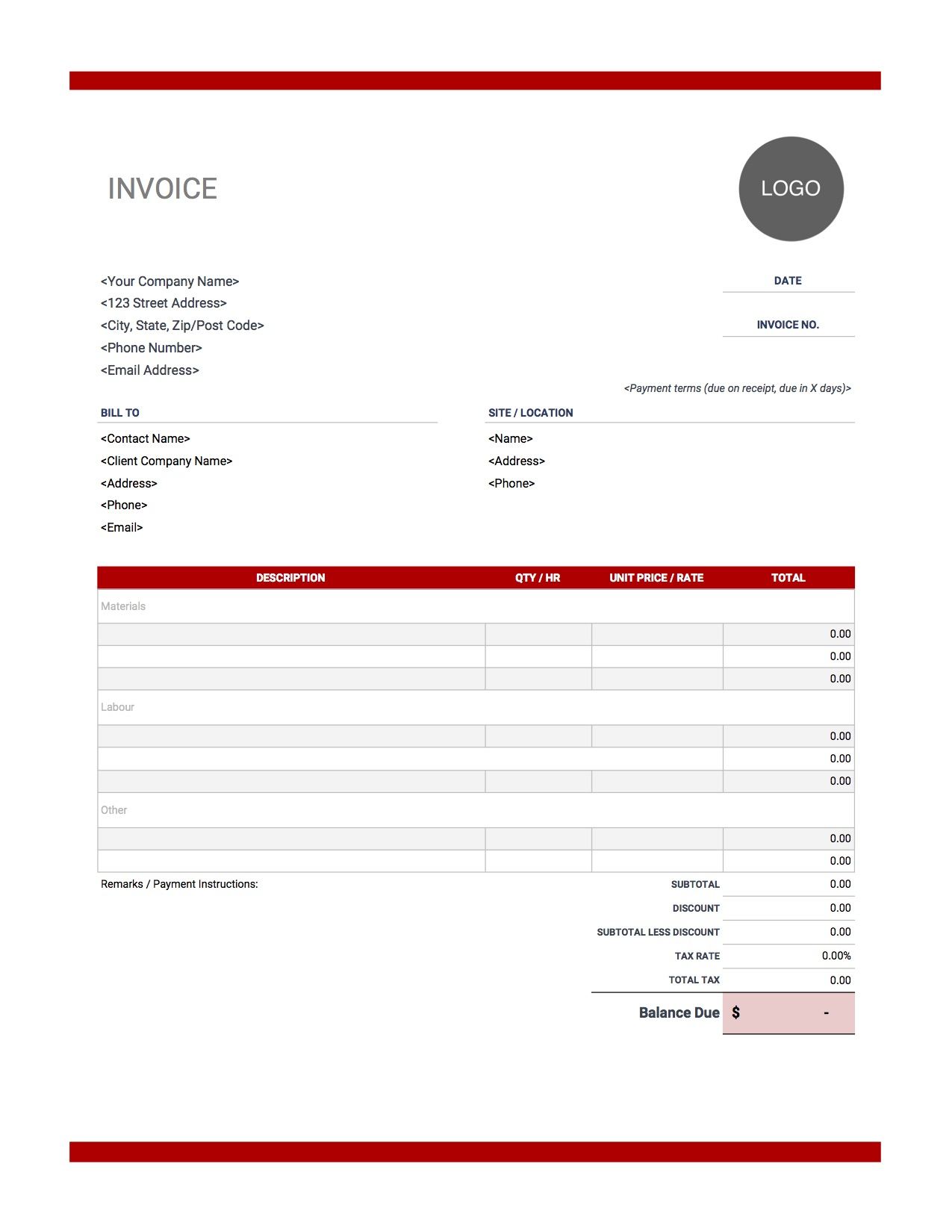

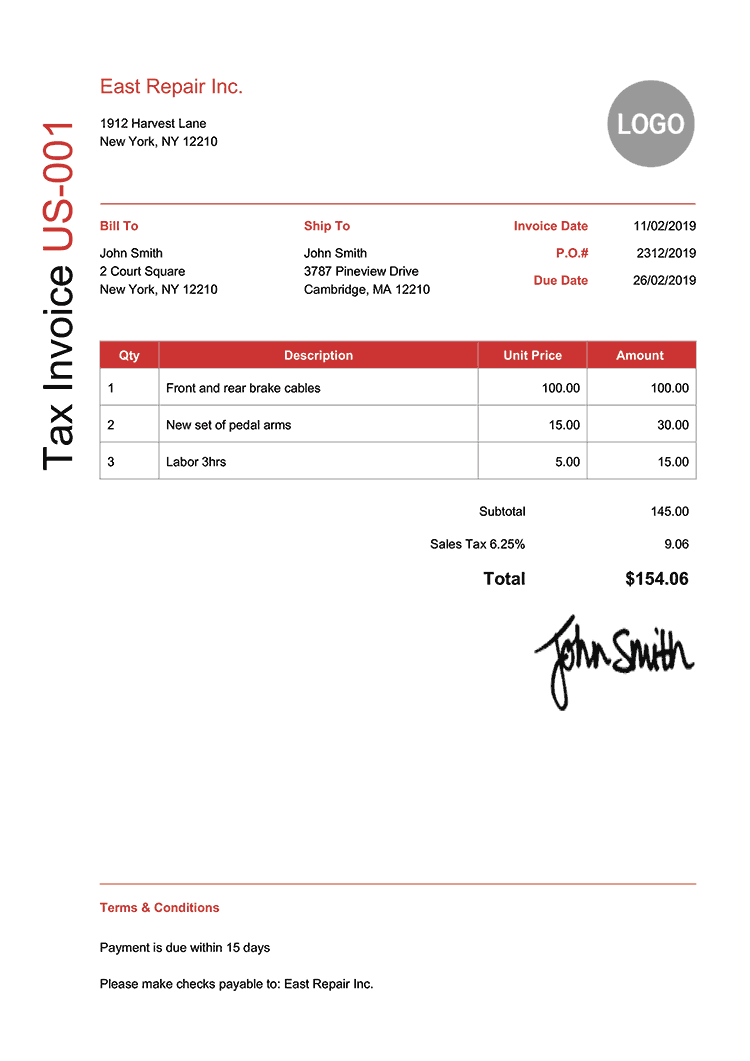

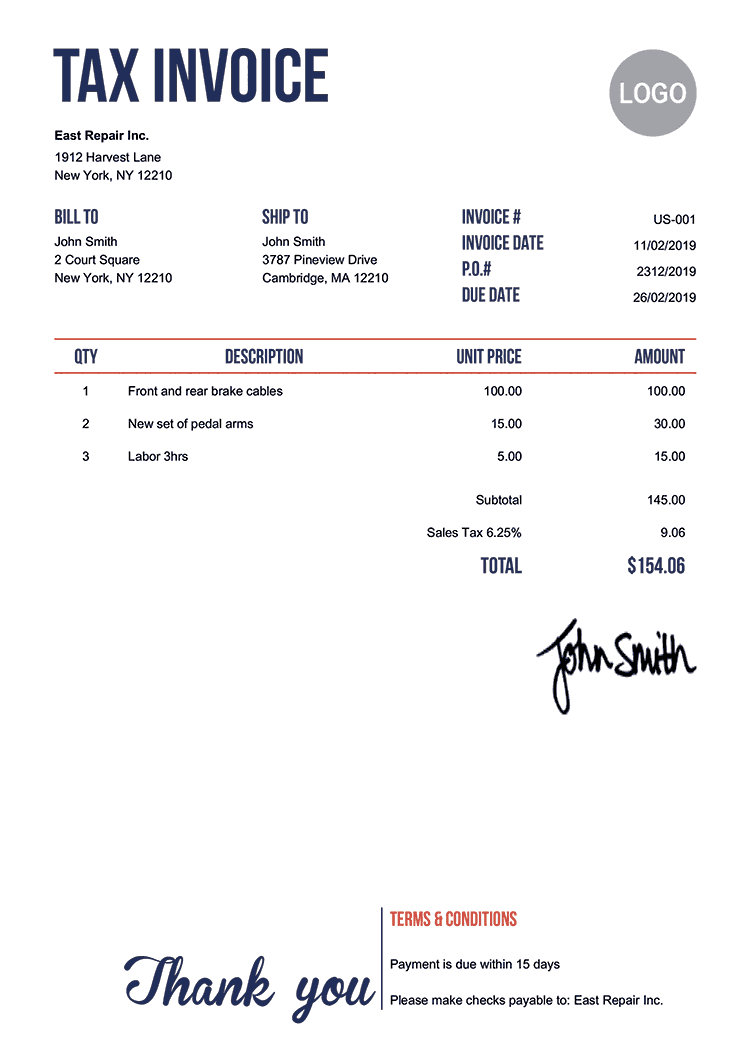

Hotel Invoice Template Print Result Invoice Template Word Invoice Template Receipt Template

The two reduced SST rates are 6 and 5.

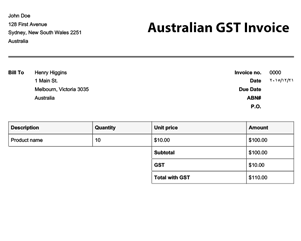

. Your business name and address. Simplified tax invoice which does not have the name and address of the recipient the maximum of input tax to be claimed must not exceed RM3000 6 GST. Once youre registered for taxes youre expected to charge 6 GST on every sale to a Malaysian resident.

Goods and Services Tax GST was implemented on 1 April 2015 at a standard rate of 6. For more information regarding the change and guide please refer to. The Goods and Services Tax was.

The sale type for example a sale that includes both taxable and non-taxable items who issues the tax invoice. Malaysia GST Reduced to Zero. All groups and messages.

For Malaysia the process for creating a credit note for a sales order has been. GST is collected by the businesses and paid to the government. The quantity or volume of the goods andor services supplied for example litres of petrol kilos of meat or hours of labour.

In the event the GST Tax invoice is not received after 30 days please contact our team at email protected within 3. Regard to GST treatment on tax invoice and record keeping. GST which was also known as a value added tax in other countries was implemented and.

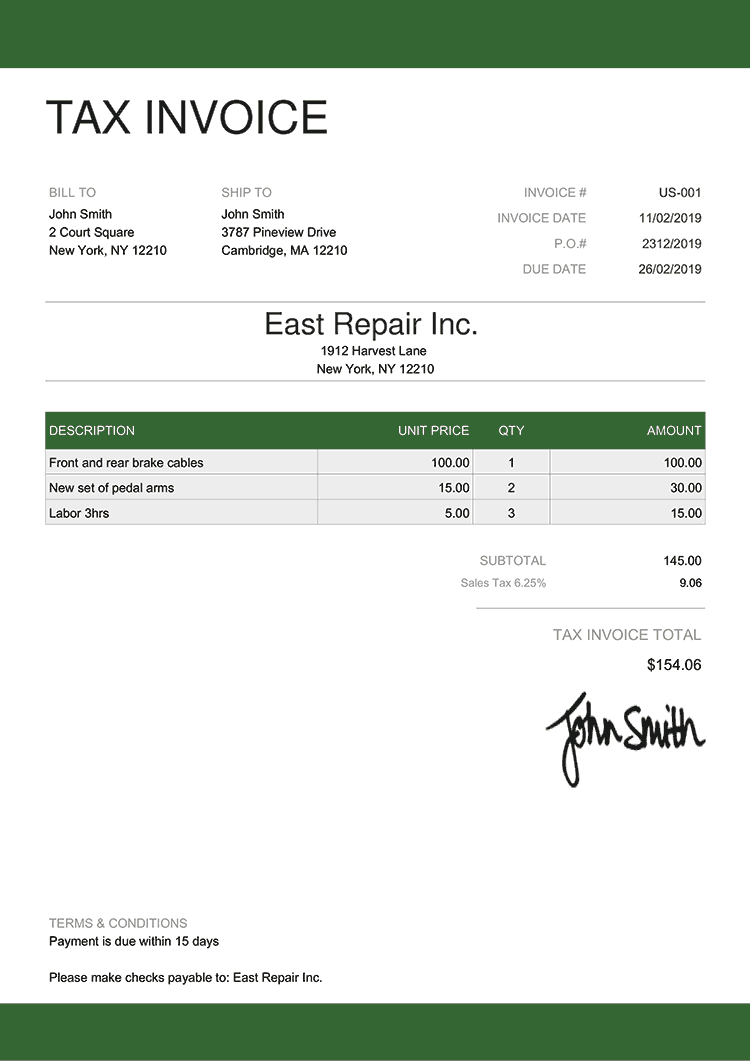

TYPES OF TAX INVOICE 4 31 Full Tax Invoice 4 32 Simplified Tax Invoice 10 33 Self-Billed Invoice 15 34 Statement of Sales or Invoice Issued by Auctioneer 19. With regard to GST treatment on tax invoice and record keeping. Overview of Goods and Services Tax GST 2.

OVERVIEW OF TAX INVOICE 1 21 Issuance of Tax Invoice 2 22 Non Issuance of Tax Invoice 3 3. If a customer asks for a tax invoice you must provide one within 28 days unless it is for a sale of 8250 including GST or less. Goods and Services Tax GST is a multi-stage tax on domestic consumption.

The tax invoice issued must clearly mention information under the following 16 headings. Goods and Services Tax GST is a multi-stage tax on domestic consumption. It also explains the functionality that is provided for GSTSST.

The Malaysian government is planning to re-implement goods and services tax GST. The total amount. The words tax invoice in a prominent place.

GST is charged on all taxable supplies of goods and services in Malaysia except those specifically exempted. Template 1 Left Logo Template 2 Centered Logo. Collecting GST in Malaysia.

In order to comply with tax laws you should include the following information on your invoices to customers in Malaysia. Malaysia GST invoice Template in Malaysian ringgit RM Currency format. 11 General Operation of Goods and Services Tax GST 1 2.

The tax invoice has to be issued within 21 days after the time of the supply. If the tax invoice is issued within 21 days from the basic tax point the tax invoice. The name or trade name address and GST identification number of the supplier.

One of the rules of GST compliance is that sales invoices issued by business must contain the following information. GST is charged on all taxable supplies of goods and services in. The invoice serial number.

Without claiming the input tax the 6 GST becomes an incremental expense for the company. The Ministry of Finance MoF announced that starting from 1 June 2018 the rate of the Goods and Service tax GST will be reduced to 0 from the current 6. The name or trade name address and GST identification number of the supplier.

Goods and Services Tax is Value Added Tax VAT that is claimable by GST registered business. Your business VAT number. The number and date of the original tax invoice.

This article provides information that will help you set up Goods and Services Tax GST and Sales and Service Tax SST for a Malaysian company. The first reduced SST rate 6 applies to restaurants hotels and accommodation car hire rental and repair domestic flights insurance credit cards legal and accounting business consulting. The information a tax invoice must include depends on.

You are required to check GST Registration Status for A Business in Malaysia to ensure the tax invoice is valid for input tax claiming. Malaysia GST invoice format. The date of issuance of the invoice.

If the recipient wants to claim the full amount of input tax more than RM3000 then he must request for his name and address to be included in the simplified tax. GST is also charged on importation of goods and. A tax invoice is required for the travellers company to claim GST input tax.

The e-ticket will be the commercial invoice under the Service Tax regime. From 1 st September 2018 Malaysia Airlines will not be issuing a Tax Invoice to passengers as no input tax credits may be claimed. GST Implementation in Malaysia The Argument.

Simplified tax invoice. Add or Edit the GST Taxes from the Set Taxes button. Find The BestTemplates at champion.

Overview of Goods and Services Tax GST 2. To avoid confusion on the customer the GST. Complete the details below to download your transaction history.

Lam Kok Shang and Gan Hwee Leng of KPMG preview the introduction of goods and services tax GST in Malaysia from April 1 2015 comparing it with the equivalent regime in Singapore and explaining what taxpayers must do to prepare for the incoming changes. GST invoices in Malaysia. GST is imposed on.

Particulars to be shown in the tax invoice. Among local airlines Air Asia provides the most. The standard goods and services tax GST in Malaysia is sales and service tax SST of 10.

Malaysia Gst Tax Invoice Template Excel Free Download 2022 by vivianflatley.

Free Invoice Templates Online Invoices

Tax Invoice Templates Quickly Create Free Tax Invoices

Sample Tax Invoice Template Australia Invoice Template Word Invoice Template Business Card Templates Download

19 Blank Invoice Templates Microsoft Word

Flipkart Seller Hub Integration With Gst Accounting Software Eztax Accounting Software Accounting Create Invoice

Word Invoice Template Free To Download Invoice Simple

Tax Invoice Templates Quickly Create Free Tax Invoices

Online Gst Accounting Software Made Easy Affordable For Smes Accounting Software Accounting Tax Services

32 Free Invoice Templates In Microsoft Excel And Docx Formats Invoice Template Invoice Design Template Balance Sheet Template

How To Add Tax Amount Column In Customer Invoice

Tax Invoice Templates Quickly Create Free Tax Invoices

Tax Invoice Templates Quickly Create Free Tax Invoices

Tax Transaction Listing Web Based Online Accounting Software Malaysia Online Accounting Software Online Accounting Software Accounting Software Accounting

Xero Foodstuffs Ni Tax Invoice Packing Slip Sku Xexl000003inps

Construction Invoice Template Invoice Simple

Gst Malaysia Full Tax Invoice Gst Malaysia Full Tax Invoic Flickr

Tax Invoice Templates Quickly Create Free Tax Invoices

Tax Invoice Templates Quickly Create Free Tax Invoices

How To Add Tax Amount Column In Customer Invoice